It really all boils down to timing and commitment. A proforma invoice is like a handshake agreement before the deal is done—it’s a preliminary, non-binding quote you send before a sale is confirmed. On the other hand, a standard invoice is the official, legally binding document you issue after the sale is finalised to actually request payment.

So, are you just setting expectations, or are you officially closing the books on a transaction? That’s the core question.

Proforma Invoice vs Invoice An Overview

Knowing which document to use and when is absolutely vital for clear communication and keeping your business operations running smoothly. Think of a proforma invoice as a highly detailed price estimate. It gives your buyer a crystal-clear picture of what’s coming without locking either of you into a financial obligation. It’s a fantastic tool for negotiation and planning, not a demand for payment.

In contrast, a commercial invoice marks the final step in the sales process. It’s the official confirmation that goods have been sent or services have been delivered, and it’s the trigger to record the sale in your accounting system. This is the document that creates a legal obligation for the buyer to pay up by the due date.

This distinction is especially important in the UK, particularly when dealing with international trade and finance. A proforma invoice is often a prerequisite for getting export-import licenses or clearing customs because it details the goods before they’re even shipped. The final commercial invoice, however, is what seals the deal and formally asks for the money. You can find more practical details on proforma invoices over at wareiq.com.

Key Takeaway: The simplest way to remember it is this: a proforma invoice is a "draft" to get everyone on the same page. A commercial invoice is the "final bill" that needs to be paid. Mixing them up can cause payment delays, confused customers, and a messy set of books.

Key Differences Proforma Invoice vs Commercial Invoice

To give you a quick, at-a-glance summary, I've put together a table that breaks down the fundamental differences between these two crucial documents.

| Attribute | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Purpose | Provides an estimate; secures sale confirmation | Requests payment for goods/services |

| Timing | Issued before goods are delivered | Issued after goods are delivered |

| Legal Status | Non-binding; not a legal demand for payment | Legally binding; an official request for payment |

| Accounting Impact | Not recorded in accounts receivable | Recorded as accounts receivable and income |

| Use Case | Customs declarations, securing financing, quotes | Finalising sales, bookkeeping, tax records |

This table should make it clear that while they might look similar, their roles in the sales cycle are completely different. Using the right one at the right time is a small detail that makes a big difference in professional business practice.

What Is a Proforma Invoice?

Think of a proforma invoice as a detailed, formal quotation—a preliminary bill of sale you send to a buyer before any deal is finalised. It's essentially a 'good faith' agreement that maps out the specifics of a potential transaction. Its main job is to give both sides a crystal-clear breakdown of the goods or services, making sure everyone is on the same page before committing.

Crucially, a proforma invoice is not a demand for payment. Unlike a standard invoice, it has no place in your accounts receivable and carries no legal weight to force a customer to pay. It’s a planning tool, plain and simple.

This document gives the buyer a preview of what the final commercial invoice will look like. It helps them arrange finance, sort out import permits, or just make an informed decision. It’s all about setting expectations right from the start.

What Goes into a Proforma Invoice?

Even though it isn't legally binding for payment, a good proforma invoice needs to be detailed to prevent any confusion down the line. You'll want to include:

- Detailed Descriptions: A clear rundown of the products or services on offer.

- Precise Quantities: The exact number of units for every item.

- Agreed Pricing: The price per unit and the grand total.

- Shipping Terms: Details on delivery costs, methods, and estimated timing.

- Seller and Buyer Details: Full contact information for you and your client.

- Validity Period: An expiry date for the quoted terms.

A proforma invoice acts as a seller's commitment to deliver goods at a specific price and under certain terms, should the buyer decide to go ahead. It effectively locks in the details of a potential sale without creating any financial obligation.

How UK Businesses Use Them in the Real World

Proforma invoices really show their worth in international trade, a situation many UK businesses find themselves in. Let’s say a UK company that makes bespoke furniture gets a big order from a client in the United States.

Before a single piece of wood is cut, the UK company sends over a proforma invoice. For the American buyer, this document is invaluable. They can use it to:

- Arrange Financing: Take the proforma invoice to their bank to secure a letter of credit or other funds for the purchase.

- Apply for Import Licences: If the goods need specific permits, the proforma provides all the product details required for the application.

- Declare Value to Customs: It allows for a pre-shipment customs declaration, which helps estimate duties and taxes and can seriously speed up the clearance process when the goods arrive.

In this scenario, the difference between a proforma invoice and an invoice is night and day. The proforma is all about managing the complex logistics of an international sale. The final commercial invoice comes later, once the furniture is built and ready to ship, to formally request payment.

The Role of a Commercial Invoice

If the proforma invoice sets the stage, the commercial invoice is the final act. This isn't a proposal or an estimate anymore; it's a legally binding demand for payment. Once it’s sent, the sale is officially finalised. The goods are on their way, or the services have been delivered.

The main job of a commercial invoice is simple: to formally ask the buyer for payment. It’s the signal that you've held up your end of the bargain, and it's time for them to hold up theirs. This is the document that turns a potential sale into an actual entry in your financial records.

And that’s a key difference. Unlike its proforma cousin, a commercial invoice is a serious accounting document. It gets logged in your books as accounts receivable and in your customer's as accounts payable. This formal record is crucial for accurate financial reporting, tax compliance, and managing your cash flow.

Essential Components of a UK Commercial Invoice

To hold up in the UK, a commercial invoice needs specific details that leave no room for confusion. These aren't just nice-to-haves; they’re often legal requirements, especially if you're a VAT-registered business.

A proper UK invoice must include:

- A unique identification number (your invoice number) so every transaction is distinct.

- The date of issue and the tax point (the actual date the goods or services were supplied).

- Your full company name and address, along with your customer’s.

- A clear breakdown of the goods or services, showing quantities and the price for each.

- Your VAT registration number, if you have one.

- The total amount due, with a clear separation of the net cost, the VAT rate and amount, and the final gross total.

Getting this information right is a fundamental part of effective billing and invoicing. These details make the document clear, professional, and legally sound, helping you avoid payment disputes and keep your records straight.

A commercial invoice is the definitive financial record of a transaction. It serves as irrefutable proof of sale for accounting, tax, and auditing purposes, solidifying the legal obligation for payment where a proforma invoice cannot.

The Legal and Financial Significance

The real power of a commercial invoice lies in its legal weight. If a customer doesn't pay by the due date, this is the document you'll rely on to pursue the debt, even through legal channels. It forms the backbone of any debt recovery process.

For tax authorities like HMRC, the commercial invoice is the official proof used to verify your sales income and work out your VAT liability. Keeping accurate, compliant invoices is essential for passing any audit. This cements the stark difference between a proforma invoice and an invoice—one is a forecast, the other is a legal and financial fact.

Comparing Proforma and Commercial Invoices

On the surface, a proforma invoice and a commercial invoice can look almost identical. But in the world of business, they play completely different roles. Mixing them up isn't just a simple mistake; it can lead to confusion, incorrect financial reporting, and even legal headaches, particularly when you're dealing with international trade.

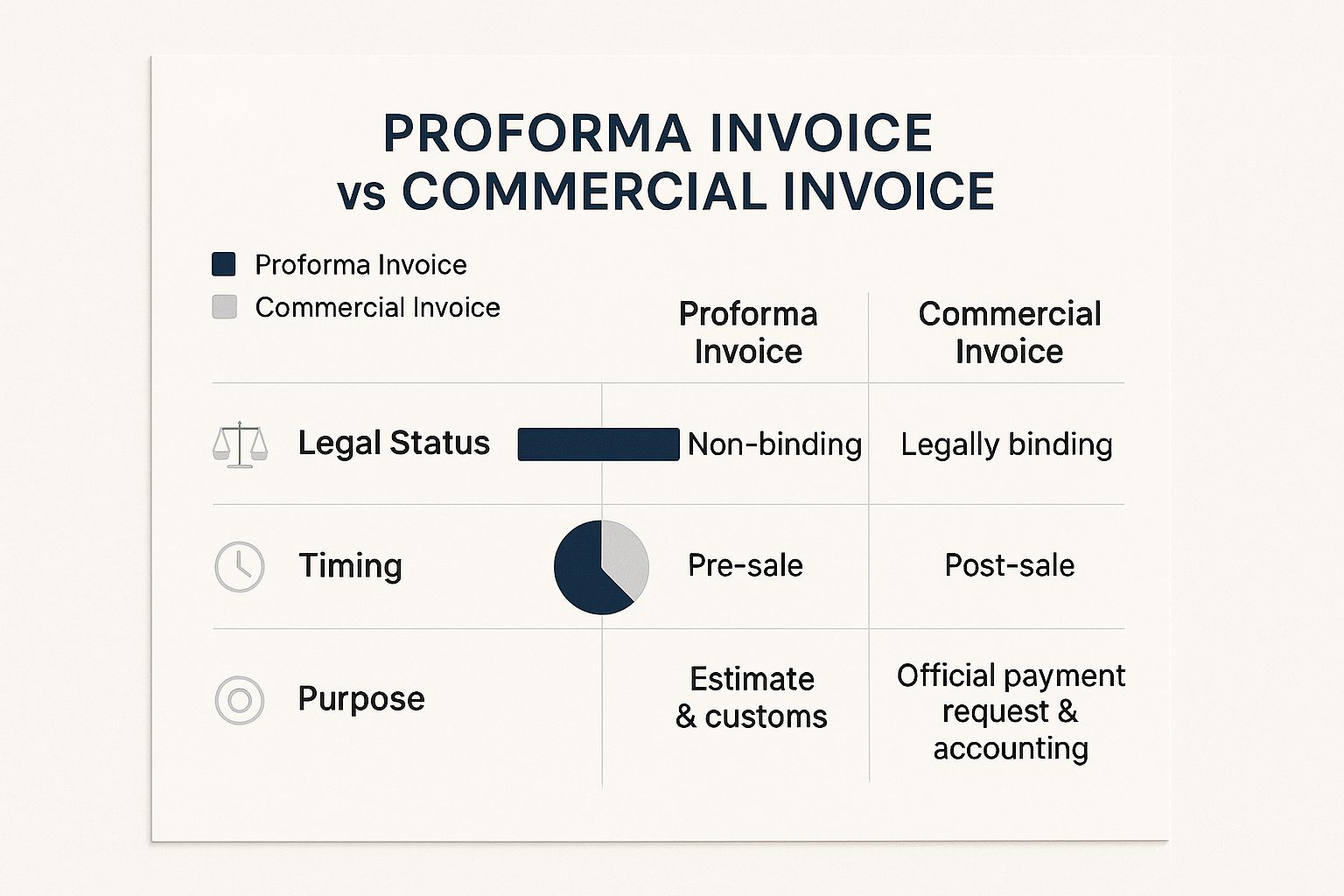

The real difference comes down to two things: timing and legal status. A proforma invoice is like a detailed quote, sent before a sale is even confirmed. In contrast, a commercial invoice is the real deal—a legally binding request for payment sent after the deal is done.

This infographic breaks down their distinct jobs based on when they're used and what they mean legally.

As you can see, the proforma is all about setting expectations before the sale. The commercial invoice, however, is what makes the transaction official and gets the financial ball rolling.

To truly get a handle on which document to use and when, let's take a closer look at how they stack up in key business areas.

Functional Comparison of Financial Documents

This table offers an in-depth look at how proforma invoices and invoices differ across key business functions, from legal enforceability to their role in accounting. It’s a quick-glance guide to their practical differences in day-to-day operations.

| Function | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Legal Status | Not legally binding. An agreement in principle. | Legally binding. Enforceable contract for payment. |

| Timing | Issued before goods are dispatched or services rendered. | Issued after goods are dispatched or services rendered. |

| Primary Purpose | To declare commitment and outline expected costs. | To formally request payment for a completed sale. |

| Accounting Entry | Not recorded in financial accounts (e.g., Accounts Receivable). | Recorded in Accounts Receivable and as Sales Revenue. |

| Payment Obligation | Does not create an obligation for the buyer to pay. | Creates a legal obligation for the buyer to pay. |

| Invoice Number | May not have a formal, sequential invoice number. | Must have a unique, sequential invoice number for records. |

This comparison makes it clear: while they share a format, their functions are worlds apart. The proforma invoice is a tool for negotiation and planning, while the commercial invoice is a non-negotiable record of a finalised transaction.

Legal and Contractual Standing

This is where the distinction matters most. A proforma invoice is not legally binding. Think of it as a formal handshake—a seller's promise to provide goods or services at a certain price. The buyer can accept it, reject it, or try to negotiate without any legal fallout. It’s an offer, plain and simple.

A commercial invoice, on the other hand, is a legally enforceable contract. The moment it’s issued, it confirms a sale has happened and creates a formal obligation for the buyer to pay up. If that payment doesn't arrive, this is the document you'll rely on to legally pursue the debt.

A signed proforma invoice can sometimes act as a sales agreement if no formal contract exists. However, it is the commercial invoice that serves as the indisputable legal record of the transaction and the official demand for payment.

Role in the Sales Cycle

Timing is everything, and these two documents mark very different stages of a transaction. Their sequence is designed to prevent any crossed wires.

- Proforma Invoice: This comes first, usually right after a customer makes an enquiry. Its job is to get everyone on the same page about the terms before the seller actually starts working on the order.

- Commercial Invoice: This is the final step. It’s sent once the goods are on their way or the service is complete, signalling that the seller has done their part and it’s time to start the payment clock.

Using them in this order ensures expectations are aligned with the proforma before the deal is sealed with the commercial invoice.

Accounting and Financial Implications

From an accountant's point of view, these documents might as well be from different planets. A proforma invoice has no direct impact on your company’s books. Because it's not a confirmed sale, it never touches the general ledger, accounts receivable, or sales revenue. It's purely a pre-accounting document.

The commercial invoice, however, is a cornerstone of your financial records. The moment you issue one, it gets logged as:

- Accounts Receivable: The amount is officially recorded as money owed to your business.

- Sales Revenue: The transaction now counts towards your company's income.

This entry is absolutely vital for managing cash flow, calculating profit, and filing your taxes correctly. Mistaking a proforma for a commercial invoice in your books can create a real mess, leading to inaccurate financial statements and potential problems with tax authorities like HMRC.

Choosing the Right Document for Your Business

Understanding the textbook difference between a proforma invoice and an invoice is one thing, but knowing exactly when to use each is where it really counts. Getting this right means clear communication, smooth transactions, and squeaky-clean financial records. Get it wrong, and you could be looking at payment delays, confused clients, and even compliance headaches.

It all comes down to where your client is in the sales process. Are they trying to get a budget approved for a big project, or are they ready to settle up after the work is done? Each stage calls for a different document.

When to Use a Proforma Invoice

Think of a proforma invoice as your go-to document for setting expectations before any money or goods actually change hands. It’s a tool for planning and getting on the same page, not for collecting payment.

A proforma invoice is perfect when your client needs to:

- Secure Financing: A buyer can take a proforma to a bank or investor to get the green light for funding a large purchase.

- Get Internal Budget Approval: In larger organisations, a department manager will need a proforma to get the purchase signed off by their finance team.

- Agree on Project Scope: For complex, service-based projects, it lays out all the anticipated costs upfront. This ensures everyone agrees on the terms before a single bit of work begins. You can learn more about how to calculate production costs in our detailed guide.

Proforma invoices are especially vital in international trade. They act as a declaration of value for customs, allowing buyers to arrange import licences or calculate duties and taxes before the goods are even shipped.

In these situations, sending a standard commercial invoice would be jumping the gun. It’s simply not appropriate because no final sale has officially happened yet.

When to Use a Commercial Invoice

A commercial invoice is the real deal—the final, official step in the transaction. It’s your way of saying you’ve held up your end of the bargain and are now formally requesting payment.

You must issue a commercial invoice:

- After Goods Are Delivered: Once the products have been shipped or handed over, the sale is considered complete and it's time to get paid.

- After Services Are Rendered: When a project is finished or a service has been provided, the invoice officially closes out the transaction.

- For Official Accounting: This is the only document that should be logged as accounts receivable in your books. It's a legally binding record of a sale.

Using these documents correctly is fundamental to good financial management. For a broader look at keeping your books in order, these practical small business bookkeeping tips are a fantastic resource.

Common Questions About UK Invoicing

Getting to grips with financial documents throws up a lot of practical questions, especially when you're trying to figure out which piece of paper is right for the job. Knowing the specific roles of a proforma invoice versus a commercial invoice is absolutely vital for clear communication and compliant financial records in the UK. Let's tackle some of the most common queries to clear up any lingering confusion.

By answering these frequently asked questions, we can pin down the real-world difference between proforma invoice and invoice, helping UK businesses operate with more confidence and precision.

Can You Legally Use a Proforma Invoice for Payment?

In a word, no. A proforma invoice isn't a demand for payment and carries no legal weight to force a client to pay up. Think of it as a quote or a declaration of intent, sent out before a sale is actually finalised. Trying to use it to chase payment is not only wrong but also looks unprofessional.

Asking for payment based on a proforma invoice is risky business. The terms aren't set in stone, and the document isn't even recorded in your accounts receivable. If a dispute pops up, you have no legally recognised document to back up your claim for payment, leaving your business in a vulnerable spot.

Crucial Insight: Always issue a final, legally binding commercial invoice after the goods have been delivered or services completed. This is the only document that officially logs the debt and gives you a legal basis for collection.

Does a Proforma Invoice Create a Binding Contract?

On its own, a proforma invoice does not create a legally binding contract. It's essentially an offer from you (the seller) to the buyer, outlining the proposed terms of a potential sale. The buyer is completely free to accept, reject, or negotiate those terms without being locked into the purchase.

But, it can get a bit more nuanced. If a buyer formally agrees to the terms on the proforma—say, by signing and returning it or sending over a matching purchase order—it can become part of a sales agreement, particularly if there's no other formal contract in place. Even so, it never replaces the commercial invoice as the official record of the sale and the actual demand for payment.

To dig deeper into topics like this, our articles on https://freispace.com/blog/tag/uk-business-finance offer more great insights. And for anyone working as a contractor, getting your head around tax-efficient contractor invoicing in the UK is also a must.

How Do You Convert a Proforma to a Commercial Invoice?

Turning a proforma into a final commercial invoice is a simple but absolutely critical step in the sales process. Once your client has agreed to the terms and you’re ready to lock in the transaction, you must create a new, separate document.

Just follow this quick checklist to make sure you get it right:

- Change the Title: Get rid of "Proforma" and clearly label the new document as "Invoice" or "Commercial Invoice".

- Assign a Unique Invoice Number: A commercial invoice needs its own unique, sequential number for your accounts. This is a legal requirement here in the UK.

- Confirm the Final Details: Double-check that all the information—product descriptions, quantities, prices—matches what you both finally agreed on.

- Add an Issue Date and a Due Date: Pop in the date the invoice is officially issued and a clear due date for payment.

- Update the Legal Status: This new document is now a legally binding request for payment. Make sure it's recorded that way in your accounting system.

This conversion is what makes the sale official, moving it from a 'maybe' to a confirmed transaction that’s properly on your books.

Ready to take control of your post-production scheduling and invoicing? freispace offers an AI-native solution that integrates resource planning, project management, and financial tools into one seamless platform. Simplify your studio's workflow and gain full visibility over your projects. Discover how freispace can help you at https://freispace.com.