Think of business budgeting software as a central hub for all your financial planning. These aren't just fancy spreadsheets; they are specialised tools designed to automate the grunt work, pull everything into one place, and get rid of those clunky, error-prone Excel files for good. They give you a live, dynamic view of your company's finances—less like a static ledger and more like a real-time financial command centre.

Why Spreadsheets No Longer Cut It for Modern Budgeting

Trying to manage your company’s finances on a spreadsheet today feels a bit like navigating London with a ten-year-old A-Z map. It’s hopelessly out of date, a nightmare to change, and one wrong turn could cost you dearly. In today's fast-moving business world, that’s a risk most UK companies simply can't afford to take.

The manual nature of spreadsheets means they’re riddled with potential for human error. We've all seen it happen—a single misplaced decimal or a broken formula can create massive blind spots in your finances, leading to some seriously flawed decisions. This old-school approach just doesn't have the agility you need to react to sudden market shifts, leaving teams stuck putting out fires instead of proactively planning for the future.

This is where dedicated business budgeting softwares come in. They act like a financial GPS for your company. You get live data, predictive insights, and a crystal-clear picture of your fiscal health, empowering you to pivot, plan, and grow with confidence.

The Shift From Manual to Automated Financials

Sticking with old methods isn't just inefficient; it puts you at a major competitive disadvantage. The modern business landscape demands speed and precision—two things manual processes simply can't deliver. Automated systems take the tedious, soul-destroying tasks of data entry and consolidation off your finance team's plate, freeing them up to focus on what really matters: high-level strategic analysis.

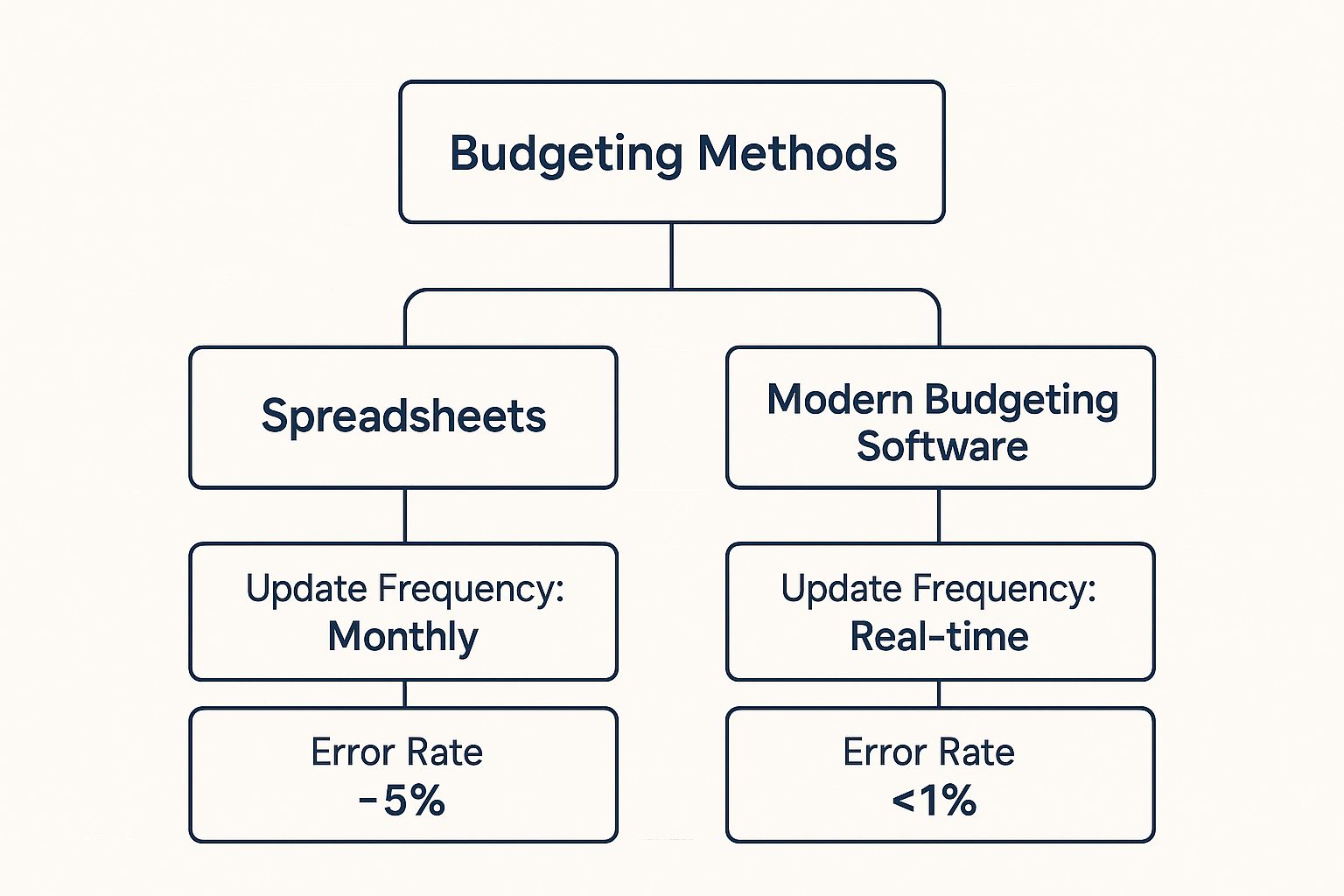

This infographic lays out the difference pretty clearly when it comes to update frequency and error rates.

The takeaway here is crucial. Software gives you real-time updates with an error rate of less than 1%, while spreadsheets are often only updated monthly and have an error rate that can easily creep up to around 5%.

Embracing a Digital-First Approach

This move towards smarter tools isn't happening in a vacuum; it’s part of a much bigger trend across UK industries. A recent survey found that a whopping 76% of UK software buyers are planning to increase their software spend in 2025. Why? Because they know they need better tech to stay in the game. It’s clear that investing in tools like business budgeting software is no longer a "nice-to-have"—it's essential for survival. You can dig deeper into these UK business spending trends on Startups Magazine.

Adopting modern budgeting software isn't just about getting a new tool. It’s about fundamentally changing how your business thinks about financial strategy. It’s about building a culture where decisions are driven by data and planning is a collaborative effort.

Making the switch from static spreadsheets to dynamic software unlocks some serious advantages:

- Enhanced Accuracy: When data is pulled in automatically, you drastically cut down on the risk of those costly human errors that plague manual spreadsheets.

- Real-Time Visibility: Having up-to-the-minute financial data at your fingertips means you can make faster, more informed decisions. No more flying blind.

- Improved Collaboration: A single, centralised platform allows different teams to work on budgets together, ensuring everyone is on the same page and working towards the same strategic goals.

Understanding the Core Features That Matter Most

Trying to get your head around business budgeting software can feel a bit like learning a new language. Every platform throws a long list of capabilities at you, but what do they actually do for your business? Instead of drowning in technical jargon, let's break down the essential features into three key functions that deliver genuine value.

Think of these features less like individual tools in a toolbox and more like an interconnected system. They work together to give you complete financial control—providing the foresight to plan, the insight to understand what's happening right now, and the connectivity to ensure all your data is spot on.

This kind of integrated approach is becoming a big deal for UK businesses. Application software, which includes these powerful budgeting tools, is now the largest chunk of the software market. It's actually projected to hold a 49.69% revenue share in 2024, which just goes to show how vital these platforms are for keeping finances in check.

Predictive Forecasting and Scenario Planning

This is where your budgeting software stops being a simple record-keeper and starts acting like a strategic advisor. Predictive forecasting digs into your historical data, using clever algorithms to create realistic financial projections. It’s like having a financial weather forecast, allowing you to anticipate cash flow peaks and troughs with surprising accuracy.

But it gets even better with scenario planning. This feature lets you play out different potential futures. What if a major client project gets delayed by two months? What happens if we hire three new team members next quarter? You can build these "what-if" scenarios to see the financial ripple effect without risking a single penny of real capital.

For a post-production studio, this is gold. You can model the budget impact of landing a huge new contract versus a smaller one. This helps you decide if you have the financial runway to hire more editors or invest in that new rendering hardware you've been eyeing. It turns pure guesswork into a proper, data-backed strategic exercise.

Live Financial Dashboards and Reporting

If forecasting is your crystal ball for the future, then live dashboards are your real-time command centre. The days of waiting until the end of the month for a static, already-out-of-date report are over. Modern business budgeting software plugs directly into your accounting systems, giving you an up-to-the-minute view of your financial health.

These dashboards are usually highly visual and you can tweak them to your heart's content, presenting complex data in charts and graphs that are actually easy to understand. You can track key performance indicators (KPIs) like revenue, expenses, and profit margins at a glance.

- Drill-Down Capabilities: See a number on the dashboard that looks a bit off? With a single click, you can dive into the underlying transactions to find the source, going from a high-level overview to the nitty-gritty details in seconds.

- Customisable Reports: Create reports that are tailored to who's reading them. The CEO might want a quick summary of profitability, while a department head needs a detailed breakdown of their team's spending against their budget.

- Automated Reporting: Set up reports to be automatically generated and pinged over to the right people daily, weekly, or monthly. This keeps everyone in the loop without adding another tedious task to your finance team's plate.

Seamless System Integration

A budgeting tool that can't talk to your other systems is just another data silo waiting to cause headaches. Seamless integration is the glue that holds your financial tech stack together, ensuring your budgeting platform can automatically pull data from your other essential business software.

This creates a single source of truth for all things financial, which means no more manual data entry—a process that’s not only slow but also a magnet for errors. When your systems are connected, your budget is always based on the freshest, most accurate data you have.

The most critical integrations for any good business budgeting software include:

- Accounting Software (like Xero, QuickBooks, or Sage): This one's non-negotiable. It makes sure your budget lines up perfectly with the actual income and spending in your general ledger.

- CRM Systems: Pulling in data from your sales pipeline gives you a much more accurate picture for revenue forecasting.

- HRIS/Payroll Systems: Linking up with your HR platform helps with planning your headcount and forecasting salary expenses with real precision.

Once you get a handle on these core functions, you’ll be in a much better position to explore the full range of capabilities that different platforms offer and find the right fit for your team.

The Strategic Gains of Better Budgeting Technology

Adopting the right business budgeting software is far more than a simple operational upgrade; it's a fundamental strategic shift. For company leaders, the real value isn't just about saving time on spreadsheets. It's about unlocking the high-level benefits that truly drive growth, stability, and a competitive edge.

These gains range from pinpoint accuracy in financial forecasts to complete visibility across every department. Most importantly, it gives you the agility to make fast, well-informed decisions when it really matters. It can fundamentally change your company's ability to plan and react.

Imagine moving beyond just looking in the rearview mirror at last quarter's numbers. Instead, you're looking ahead with a clear, data-driven roadmap for what's to come.

This jump from reactive to proactive financial management is where modern budgeting tech truly shines. It turns the finance function from a simple reporting centre into a strategic powerhouse.

From Chaotic Reporting to Strategic Foresight

Let’s take the story of 'Apex Solutions', a fictional UK-based consultancy. Before they found dedicated software, their financial planning was a mess of disconnected spreadsheets. Quarterly reporting was a dreaded, week-long scramble, manually pulling data from different departments. It was slow and riddled with errors—a huge risk, considering nearly 90% of spreadsheets contain mistakes.

Their leadership team was constantly making decisions based on old news. By the time they had a clear picture of their finances, the quarter was already over, and any chance to adjust their strategy was long gone. They were stuck just reacting to problems instead of getting ahead of them.

This lack of foresight made effective planning impossible. Big questions like, "Can we afford to hire two new consultants next month?" or "What's the financial fallout if our biggest project is delayed?" were met with educated guesses rather than hard data. This uncertainty was holding back their growth and exposing them to unnecessary risks.

The core problem wasn't just inefficiency; it was a total lack of strategic capability. Without a single source of truth for their financial data, Apex couldn't align their budget with their business goals. True strategic planning felt completely out of reach.

Achieving Clarity and Agility

The switch to a modern business budgeting platform was a genuine game-changer for Apex Solutions. The new system integrated their accounting, project management, and CRM tools into one central hub. Suddenly, that chaotic quarterly scramble was gone, replaced by a smooth, automated process delivering real-time insights.

This newfound clarity had an immediate and powerful impact on their strategy.

- Pinpoint Forecasting Accuracy: Instead of relying on guesswork, Apex could now use predictive tools to model different revenue scenarios. They could finally see the precise financial impact of winning new business or facing project delays, letting them make proactive hiring and spending decisions with confidence.

- Complete Financial Visibility: Department heads got access to live dashboards showing their team’s spending against the budget. This gave them a sense of ownership and accountability, leading to smarter financial management across the board. It also became a critical part of their resource management—a concept you can dig into in our guide on what resource planning is.

- Decisive Agility: When an unexpected opportunity to bid on a large project came up, the leadership team didn't have to wait weeks for a report. They could instantly analyse their cash flow and resource availability, which allowed them to make a quick, data-backed decision to go for it. Before, they would have been far too hesitant to make that move.

For Apex, the software did more than just organise their numbers; it gave them the strategic vision to navigate their market with confidence. To get the most out of these tools, many businesses also bring in professional budgeting services to help sharpen their financial strategies.

How to Choose the Right Software for Your UK Business

Picking the perfect business budgeting software can feel a bit like navigating a maze. There are so many options out there, each one promising to solve all your financial headaches, and it’s easy to get lost in the noise. The real key is to take a step back from the slick sales pitches and start with a solid understanding of what your business actually needs.

Think of it like you're casting a lead role in a new production. You wouldn't just hire any actor who walked in; you'd have a detailed character brief. What skills do they need? How do they fit into the bigger story? It's the same with software. You need a "casting brief" that outlines exactly what role this platform will play in your company's financial operations.

It all starts with a simple self-assessment. Once you define your unique requirements, you can filter out the distractions and zero in on the tools that will genuinely help you hit your goals. That’s how you make a smart, sustainable investment.

Define Your Non-Negotiable Features

Before you even think about watching a demo, sit down and make a checklist of your absolute must-haves. What are the core problems you're trying to fix? Is it wonky forecasting? Messy collaboration between producers and finance? Or just a complete lack of real-time visibility into project spend? Your biggest pain points should be your top priorities.

This isn't about finding a tool with the longest list of features; it's about finding the one with the right features for your team.

A UK-based post-production studio, for example, has completely different needs from a high-street retailer. Their must-have list would probably look something like this:

- Project-Based Budgeting: The ability to create, track, and manage budgets for individual projects is non-negotiable. You have to know if each client engagement is actually profitable.

- Resource Allocation Links: The system must connect your financial budgets to your staff and suite scheduling. This ensures your projects are not only profitable on paper but are also properly resourced in reality.

- Integration with Xero: A seamless, real-time link to your UK-specific accounting software is critical to kill off manual data entry for good.

- Multi-Currency Support: Essential for managing costs and billing when you're working with international clients, artists, and suppliers.

Once you have this core list locked down, you can start adding "nice-to-haves." This simple framework will become your scorecard for evaluating different options, helping you make a decision based on facts, not feelings.

Assess Scalability and Integration Needs

Your business isn't standing still, so why would you pick a software that is? Think about where your company will be in two, five, or even ten years. A tool that feels like a perfect fit today could become a frustrating bottleneck as you grow, add new team members, or branch out into new services.

Look for a platform that can scale with you. Does it offer different plans that let you add more users or unlock advanced features when you're ready? Can it handle more complex financial models as your business evolves? Choosing a scalable solution from day one saves you the massive headache of having to migrate everything to a new system down the line.

Just as important is how the software plays with your current tech stack. A brilliant budgeting tool that doesn't talk to your other systems just creates more work, not less.

Map out the software you already rely on—accounting, CRM, project management, payroll—and make sure any potential budgeting tool offers solid, pre-built integrations. This connectivity is what turns your data into a single, reliable source of financial truth for the whole operation.

Run Effective Demos and Ask Tough Questions

Software demos are your chance to peek behind the curtain and see how the platform actually works in the real world. Don't let the sales rep drive the whole session with their generic pitch. Come prepared with your own script and specific scenarios that matter to your business.

For instance, ask them to walk you through setting up a project budget for a six-month video editing job, assigning specific team members, and then tracking actual spend against that forecast in real time. This practical test will tell you far more than a glossy presentation ever could.

When you're looking at budgeting software, it's also smart to explore how different tools handle core functions. Checking out a detailed review of the best business expense tracking apps can give you a better sense of the options out there for crucial components. On top of that, data security is paramount, especially with UK regulations. You need to ask direct questions. For a deeper dive into this, you can learn more about our commitment to data safety and GDPR compliance.

Ultimately, your goal is to find a partner, not just a product. The right software will slot neatly into your financial processes, support your team's workflow, and give you the strategic insight you need to drive your UK business forward.

Your Guide to a Smooth Software Implementation

Picking the right business budgeting software is a huge step, but the journey doesn't end there. How you actually roll out the new platform is just as critical as the tool you've chosen. A great implementation turns your investment into an immediate asset, while a chaotic one can cause frustration, kill adoption, and leave you with a powerful tool that nobody uses.

Think of it like getting a state-of-the-art editing suite. The hardware is brilliant, but without a proper setup, workflow integration, and training for your editors, it’s just an expensive box collecting dust. The same principle applies here. A smooth, well-planned implementation ensures you get real value from your software from day one.

This guide is your roadmap through the whole process, from prepping your data to training your team, so you can manage the change and transition without the headaches.

Stage 1: Preparing Your Data for Migration

Before your new system can do anything, you need to feed it the right fuel: your financial data. This is probably the most crucial stage. The quality of your data directly impacts the accuracy of everything that comes after. A messy data migration is a classic pitfall, so take your time and get this right.

Start by conducting a thorough data audit. Go through all your existing spreadsheets, accounting records, and project files. Think of it as a much-needed spring clean.

- Cleanse and Standardise: Hunt down and eliminate duplicate entries, correct obvious errors, and make sure your formatting is consistent. That means standardising things like client and project names so they match up perfectly.

- Decide What to Migrate: You probably don't need to import every single transaction from the last ten years. Choose a sensible cut-off point, like the last two or three fiscal years. This will keep your new system focused and responsive.

- Map Your Data: Figure out exactly where information from your old system will go in the new one. For instance, 'Project Codes' in your spreadsheets might map to a 'Projects' field in the new software. Sketching out a simple map will make the import process so much easier.

Stage 2: Configuring the Platform and Running Tests

With your data clean and ready, it's time to set up the software to fit your team's unique workflows. This isn't about just clicking 'next' on the default settings; it’s about moulding the platform to the way your business actually works. Work closely with your software provider’s onboarding team to configure user roles, permissions, and reporting templates.

For a post-production house, this is where you set the system up to handle project-specific budgets. You’ll want to create templates for different types of jobs—say, a 30-second commercial versus a feature-length documentary—to make budgeting for new projects much faster.

Before going live, a pilot test is non-negotiable. Pick a small, self-contained project or department to try the new system first. This controlled test lets you find and fix any quirks in a low-stakes environment, preventing major headaches when you roll it out to the entire company.

This testing phase is also a great chance to get early feedback from a few key users. They'll be able to point out confusing processes or suggest configuration tweaks that will make life better for everyone. It’s far easier to make these adjustments before the whole team is on board.

Stage 3: Executing a Team Training Plan

Technology alone doesn’t solve problems; people do. A solid training plan is the key to making sure your team actually embraces the new software instead of resisting it. Good training is more than a single two-hour webinar—it should be an ongoing process, tailored to different roles.

Your producers, for example, need to know how to create and track project budgets. Your finance team, on the other hand, will need a much deeper understanding of the system's reporting and forecasting tools. Customise the training to focus on what each group needs to do their job well.

To get everyone on board, try these best practices:

- Appoint Internal Champions: Find a few tech-savvy and enthusiastic team members to become your 'super-users'. They can be the first port of call for their colleagues, answering questions and championing the benefits of the new system from within.

- Provide Practical Resources: Don't just rely on live training sessions. Build a library of resources like short video tutorials, quick-start guides, and FAQs that your team can dip into whenever they need a quick reminder.

- Focus on the "Why": Make sure everyone understands why this change is happening. Show them how the new software will make their jobs easier—no more late-night spreadsheet wrangling or chasing down project numbers. When people see what's in it for them, they're much more likely to get on board.

Common Questions About Business Budgeting Software

Diving into the world of dedicated financial software can feel like a big step. It’s totally normal to have a few questions before you commit. We’ve pulled together the most common queries we hear from UK businesses, so you can get clear on the details and feel confident about your decision.

Think of this as your final checklist. It’s all about getting straightforward answers on cost, integrations, and what the transition really looks like. This isn't just about the tech; it's about seeing how it will slot into your daily work and what to expect when you finally wave goodbye to those manual spreadsheets.

How Much Should a Small UK Business Expect to Pay?

The price tag for business budgeting software here in the UK really does vary, all depending on what you need it to do. For tiny businesses or sole traders, you’ll find basic plans that start from around £15 to £40 a month. These are perfect for simple tracking and getting your plans in order.

For most small to medium-sized businesses (SMEs), you'll likely need more firepower—things like advanced integrations and detailed scenario planning. For that, you’re typically looking at a range between £75 and £250 per month. Of course, huge enterprise-level systems are a different beast entirely, usually priced to spec and running into several thousands of pounds a year.

When you’re weighing up the costs, don't just look at the monthly fee. Consider the total cost of ownership. That includes any one-off charges for setup, getting your data moved over, or any special training. Sometimes, a slightly more expensive platform with fantastic support is much better value in the long run than a cheaper option that leaves you to figure it all out on your own.

Can Budgeting Software Integrate with Tools Like Xero or QuickBooks?

Absolutely. In fact, this is one of its biggest selling points. Any budgeting platform worth its salt is built to connect with other tools. Almost all the leading business budgeting software options are designed to link up seamlessly with the big UK accounting systems like Xero, QuickBooks, and Sage.

This connection automates the whole flow of financial data. It means no more mind-numbing manual data entry, which doesn't just save a massive amount of time; it also slashes the risk of human error.

With a solid integration in place, your budget is always built on a foundation of real-time, accurate financial data pulled straight from your official accounts. It means the numbers you’re using for planning are always reliable. Before you sign up for anything, double-check that it offers a proper, pre-built connection to the exact accounting system you use.

Is It Difficult to Switch from Excel to a Dedicated Tool?

Honestly, there’s a bit of a learning curve at the start, but the long-term payoff almost always smashes the short-term effort. Making the switch is less about technical wizardry and more about good planning and getting your team on board.

The two main hurdles are moving your old financial data across and getting your team comfortable with the new system. Good software providers know this and make it much easier than you’d think. They usually have structured onboarding, a library of video tutorials, and a support team ready to help you every step of the way.

Think about the upsides:

- Time Savings: The hours you'll get back from not having to wrestle with spreadsheets are huge.

- Fewer Errors: You can finally stop worrying about broken formulas or copy-paste nightmares.

- Better Insights: The ability to collaborate in real time and pull instant reports gives you a strategic edge that Excel just can't offer.

At the end of the day, a smooth transition boils down to picking a user-friendly platform and putting a little time into planning the move. The efficiency and clarity you'll gain will repay that initial effort many times over.

Ready to see how a modern, intuitive platform can transform your post-production budgeting? freispace combines powerful resource management with seamless financial planning to give your studio the clarity and control it needs. Discover a smarter way to manage your projects and finances today.